At the New York Spa Conference this past May, Todd Walter, CEO of Red Door Spa Holdings Inc., uncovered the secrets to his company’s plans for world-wide development.

There is a lot to learn from the Red Door Spa Holdings company, which operates as a day spa with a clustering model of 51 locations in the US. The company’s plans for growth and development—to introduce their freestanding spas into international markets, to expand their partnerships with hotel companies, and to open locations in every major city worldwide—are ambitious, even at a glance. But couple these goals with their implementation strategy and it becomes not only actionable, but admirable.

Red Door started by identifying influences for their expansion, just to be sure it was the proper move. When they indicated 7 motivators—customer data, demographics, psychographics, local retailers, business climate, site store factors, and competition—expansion seemed inevitable. In order to design the best plan of action, Red Door asked themselves a series of major questions:

- What are our customers’ profiles, and, as such, our target market?

- What are our top predictors of revenue?

- How can we use our research data to predict success in future locations?

- Why are we currently successful?

With these pivotal questions in mind, Red Door first decided to rank the markets based on demographics and psychographics by researching 1,000 of their guests. They used the MOSAIC Database to break down the population into 18 categories. Major discoveries about their customer profile included the following:

- 57% of guests are over the age of 35

- 58% of guests graduated with a Bachelor of Science or a higher degree from college

- Median household income of guests is $102k

- 81% of guests hold managerial/professional occupations

- 39% of guests earn over $300k per year

- Majority of guests live within a 5 mile radius of the spa—in fact, Coyle Hospitality Group’s Global Spa Report indicates that 42% of consumers choose a spa based on proximity

To uncover their top revenue-predictor and use it to predict success in future locations, Red Door used the “Bulls-Eye Model.” With 958 variables of success and data from all existing locations, they were able to determine their biggest predictor of sales revenue: location. They then defined their target revenue to be $3MM; those locations bringing in more than $4MM in revenue were classified as great performers, while those bringing in less than $2MM were under-performers. With a list of their best and worst operating locations, Red Door could start making informed decisions about their future, both domestically and internationally.

Red Door looked into their history to understand why they have been successful in the past. A major factor was their ability to persuade hotel companies to partner with them. They simply educated the hotels on the benefits of having a spa in a hotel: primarily, the fact that ADR and revenue will increase over time. Though this change will not be seen automatically, the spa is a profitable investment in the long-run. This became yet another useful tactic for Red Door’s future.

As for the company’s outlook in the global market, Red Door took into consideration a macro-view of the global hospitality industry, the political stability and industry growth of foreign markets, the language barriers in place, and the regulatory environment and legal structures abroad. These considerations, combined with the knowledge of their domestic locations’ history, allowed Red Door to proactively plan for their expansion outside of the US.

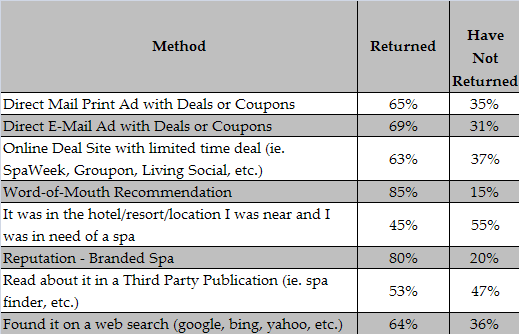

Red Door then brainstormed to determine the most attractive markets. They decided to focus on areas with these characteristics: countries with a focus on service over manufacturing, democratic nations, regions that offer the ability to form a joint venture to balance risk, and places that would enable them to employ the best people. The first quality, the focus on service, is monumental. As you can see in the chart below, taken from Coyle’s Global Spa Report, 85% of consumers return to a spa because of a positive word-of-mouth recommendation.

Guests who experience a successful spa visit will become repeat guests and will promote the business to other consumers. The final attribute discovered by Red Door, recruiting the best employees, is also key—a GM can make or break an operation no matter how perfect the site selection.

Red Door finally asked consumers to complete a survey. The responses indicated three important characterizations. First, Red Door was perceived as an older brand despite the fact that their average guest age is 38. They would have to strategize to eliminate that image. Second, they had a premium luxury reputation, so they needed to deliver on it. Finally, they were known to focus on the guest experience; for them, the size of the spa should not be as important for revenue purposes as guest satisfaction is. Knowing how they are perceived by guests allowed Red Door to finalize their plan of action.

To read more about the spa industry from Coyle Hospitality Group or to view Coyle’s full Global Spa Report, please visit https://coylehospitality.com//mystery-shopping-services/spa-consulting/.